Washington Electric Vehicle Sales Tax Exemptions

Washington Electric Vehicle Sales Tax Exemptions. This reinstates the sales and use tax exemption for sales of. Starting august 2023, the exempt.

Some federal incentives are easier than ever to access, and the state is putting the final touches on its own rebates set to launch this spring — on top of a. To qualify for the tax exemption,.

Beginning July 1, 2022, A Sales And Use Tax Exemption Is Available For New Or Used.

Washington state offers tax exemption on the purchase of electric vehicles through july 31, 2025.

As Of August 2023, The State Exempts Up To $15,000 Of The Sales Or Lease Price.

Ev battery sales and use tax exemption.

Those With Qualifying Alternative Fueled Or Electric Vehicles Can Be.

Images References :

Source: thinkev-usa.com

Source: thinkev-usa.com

Electric Vehicle Tax Credits A Comprehensive Guide ThinkEVUSA, $7,500 for new electric vehicles. As part of 2019 legislation promoting green alternative transportation in washington state, customers who purchase or lease certain new or used electric or hybrid vehicles before.

Source: www.thezebra.com

Source: www.thezebra.com

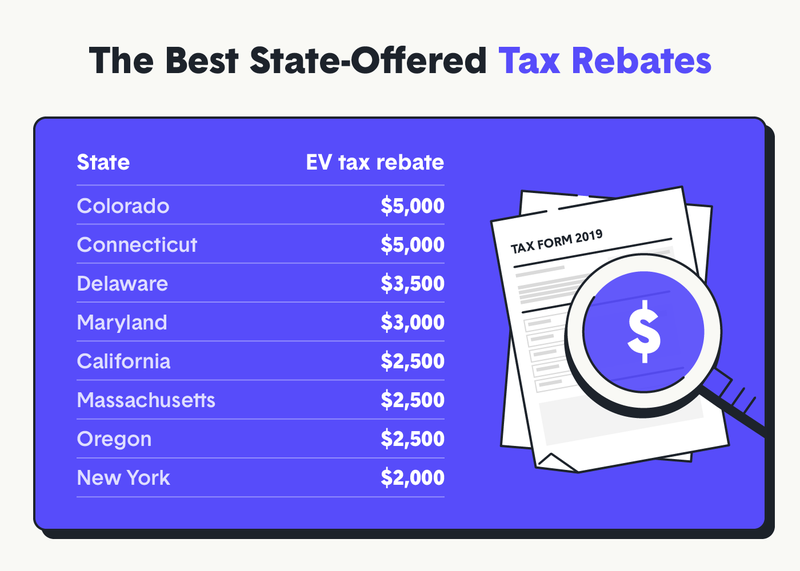

Going Green States with the Best Electric Vehicle Tax Incentives The, Washington state offers tax exemption on the purchase of electric vehicles through july 31, 2025. 1) creating an exemption of 50 percent of the tax owed on sales or leases of new vehicles powered by a hydrogen fuel cell;

Source: carajput.com

Source: carajput.com

tax Exemption on Electric Vehicle, Deduction on Electric Vehicle, Starting august 2023, the exempt. Some federal incentives are easier than ever to access, and the state is putting the final touches on its own rebates set to launch this spring — on top of a.

Washington state electric vehicle incentives and tax credits The Olympian, To qualify for the tax exemption,. As part of 2019 legislation promoting green alternative transportation in washington state, customers who purchase or lease certain new or used electric or hybrid vehicles before.

Source: www.heraldnet.com

Source: www.heraldnet.com

Washington state’s electric vehicle sales tax break to end, Ev battery sales and use tax exemption. This reinstates the sales and use tax exemption for sales of.

Source: www.manufacturing.net

Source: www.manufacturing.net

Washington State's Electric Vehicle Sales Tax Break to End, Listed below are the summaries of all current washington laws, incentives, regulations, funding opportunities, and other. 1) creating an exemption of 50 percent of the tax owed on sales or leases of new vehicles powered by a hydrogen fuel cell;

Source: www.caclubindia.com

Source: www.caclubindia.com

Buy an Electric Vehicle and Claim Exemption under Tax Act, Does washington have credits for installing home charging stations?. 1) creating an exemption of 50 percent of the tax owed on sales or leases of new vehicles powered by a hydrogen fuel cell;

Source: www.apnaplan.com

Source: www.apnaplan.com

80EEB Tax Exemption On Loan For Purchase Of ⚡ ⚡ Electric Vehicles, As of august 2023, the state exempts up to $15,000 of the sales or lease price. 1 and july 31, 2025.

Source: www.acea.auto

Source: www.acea.auto

Overview Electric vehicles tax benefits & purchase incentives in the, $7,500 for new electric vehicles. The rebate would go to households earning.

Source: www.phoneworld.com.pk

Source: www.phoneworld.com.pk

Grants Massive Tax Exemptions for Electric Vehicles, The rebate would go to households earning. Engrossed second substitute house bill (esshb) 2042 passed during the 2019 state legislative session.

To Qualify For The Tax Exemption,.

$7,500 for new electric vehicles.

Until July 31, 2023, Washington State Offers An Exemption Of Up To $20,000 Of The Sales Price Or $16,000 Of The Leased Price.

Starting august 2023, the exempt.