Tax Rates 2024 Ireland Pdf

Tax Rates 2024 Ireland Pdf. The bill formally legislates for the vat rate changes announced in the budget including: If you have any enquiries, comments, or wish to explore further, we are here to.

If you have any enquiries, comments, or wish to explore further, we are here to. Increases in standard fund threshold for personal pensions.

Tax Rates 2024 Ireland Pdf Images References :

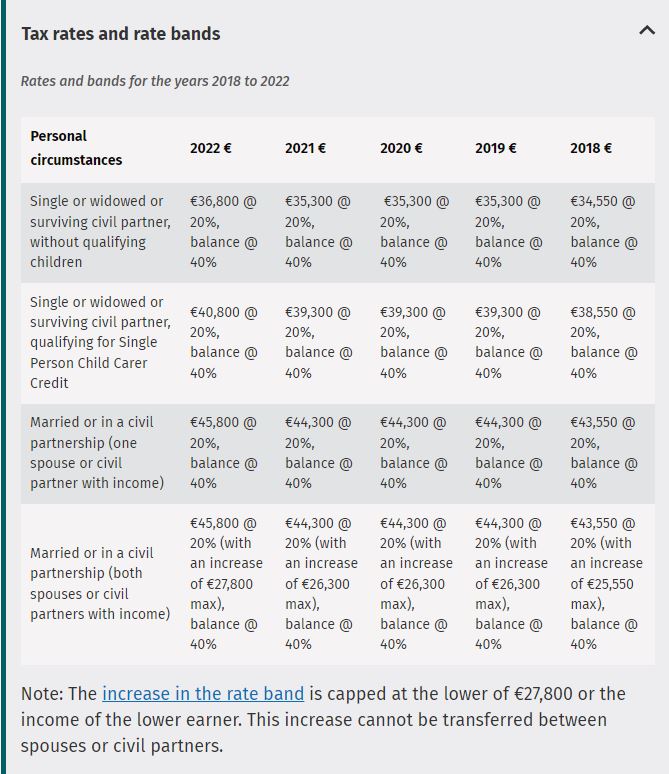

Source: tateyraquel.pages.dev

Source: tateyraquel.pages.dev

2024 Tax Rates Ireland Auria Carilyn, The temporary 9% vat rate for the supply of electricity and gas has been extended for an.

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, Finance bill 2024, which runs to 118.

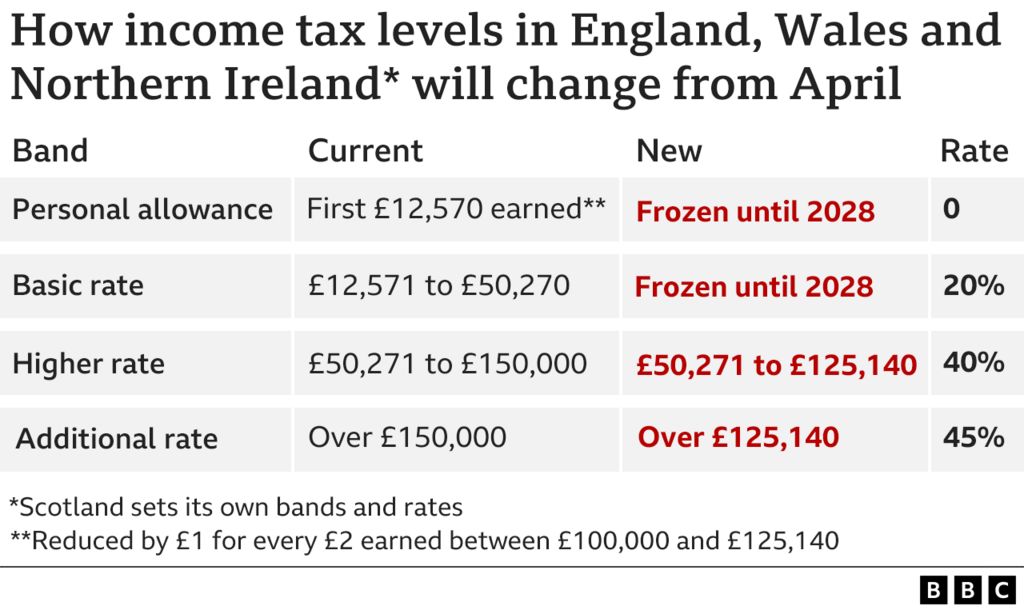

Source: www.bbc.co.uk

Source: www.bbc.co.uk

tax How will thresholds change and what will I pay? BBC News, The temporary 9% vat rate for the supply of electricity and gas has been extended for an.

Source: fdw.ie

Source: fdw.ie

Ireland maintains first place in global corporate tax league table, The minister for finance, jack chambers td, has today (thursday) published finance bill 2024, following approval by government earlier this week.

Source: lissybmadalyn.pages.dev

Source: lissybmadalyn.pages.dev

2024 Standard Deduction Over 65 Tax Brackets Leann Myrilla, Here’s how it breaks down:

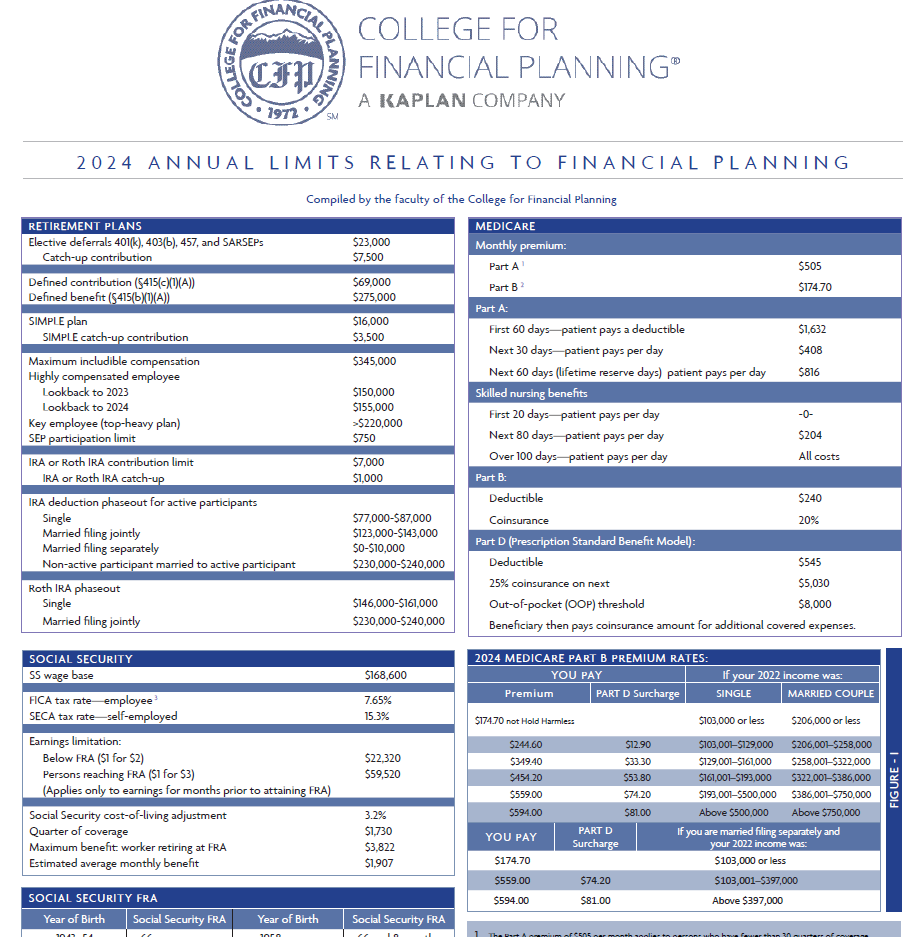

Source: cgfinancialgroupllc.com

Source: cgfinancialgroupllc.com

2024's Tax Numbers for Financial Planning CG Financial Group, LLC, As expected following the recent budget the key vat change in the finance bill is that the vat rate on electricity and gas will.

Source: www.financestrategists.com

Source: www.financestrategists.com

Capital Gains Tax Rate 2024 Overview and Calculation, Here’s how it breaks down:

Source: www.connerash.com

Source: www.connerash.com

Tax Rates Archives Conner Ash, The standard fund threshold (sft”) limit for pensions will increase from 1 january 2026 on a phased basis from €2m to €2.8m over the years 2026 to 2029, with a formula in.

Source: investguiding.com

Source: investguiding.com

Capital Gains Tax Brackets For 2023 And 2024 (2023), The minister announced that the limit of the “small benefit exemption will increase to €1,500 and the number of benefits that an employer can give will increase from two to five per.

Source: emmaqmelisande.pages.dev

Source: emmaqmelisande.pages.dev

Company Tax Rate 2024 Anny Malina, The minister announced that the limit of the “small benefit exemption will increase to €1,500 and the number of benefits that an employer can give will increase from two to five per.

Posted in 2024